May 10, 2022

By: Freedom to Prosper Team

Next year’s borrowers will have to take out a new loan at a higher interest rate than in previous years. Federal student loan rates change in the month of May per the U.S. Treasury Department’s auction of 10-year notes.

Interest rates are most likely to change from the current 3.73% rate for undergraduate loans to 5.1%. It’s worse for graduate students as interest rates will likely jump from the current 5.28% to an estimated 6.66%.

That’s bad news for new borrowers next year and even worse news for Black Americans who are disproportionately affected by student loan debt. The Education Data Initiative reports the average Black college student owes $25,000 more than their white peers, and according to the Brookings Institution, Black students are also five times more likely to default on student loan debt than their white peers.

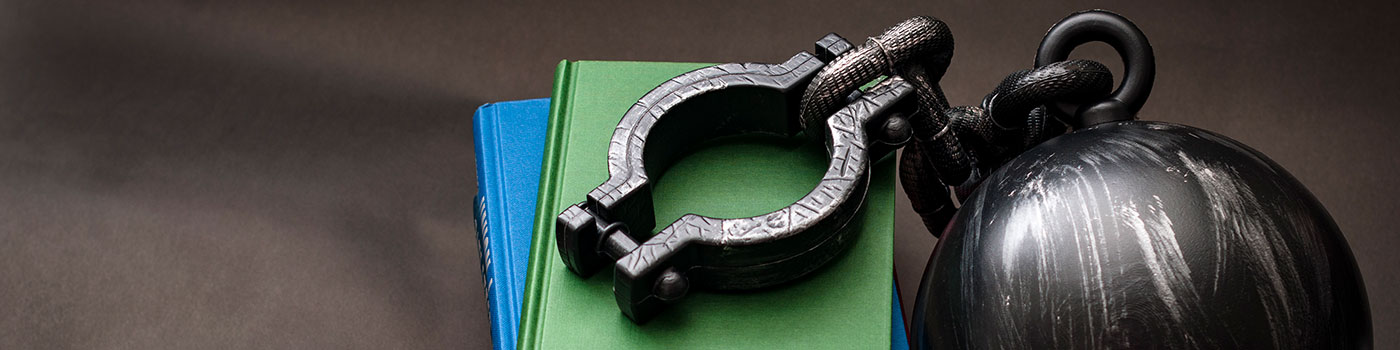

These higher interest rates perpetuate the trap of student loan debt, further hurting millions of Americans and their families with many falling into spiraling debt with no hope in sight.

Canceling student loan debt would help close the racial wealth gap, ensuring more Americans have the opportunity to gain economic freedom and a greater ability to prosper.

Sign our pledge to show that you support debt freedom!

Student debt impacts millions of people, of all ages.

What would you do if you were free from the student debt trap? How would your life be different?

Submit Story